On Wednesday evening, international gold prices broke through the $5,500 per ounce mark, with spot gold rising 2% to a historic high of $5,588.36 per ounce, bringing the cumulative gain for the week to nearly 9%. Since the beginning of this year, gold prices have increased by approximately 20%, far surpassing the full-year growth of last year.

()

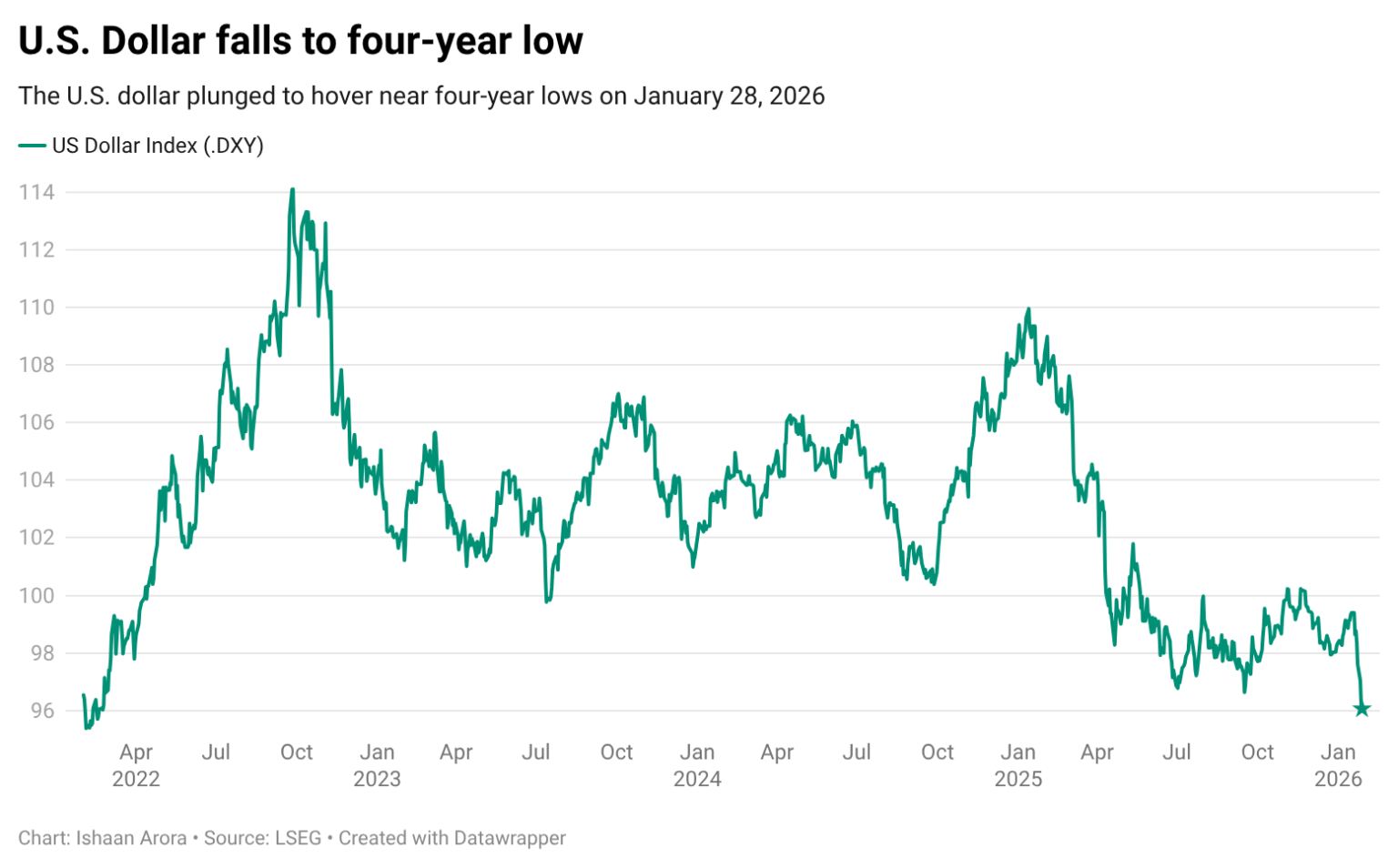

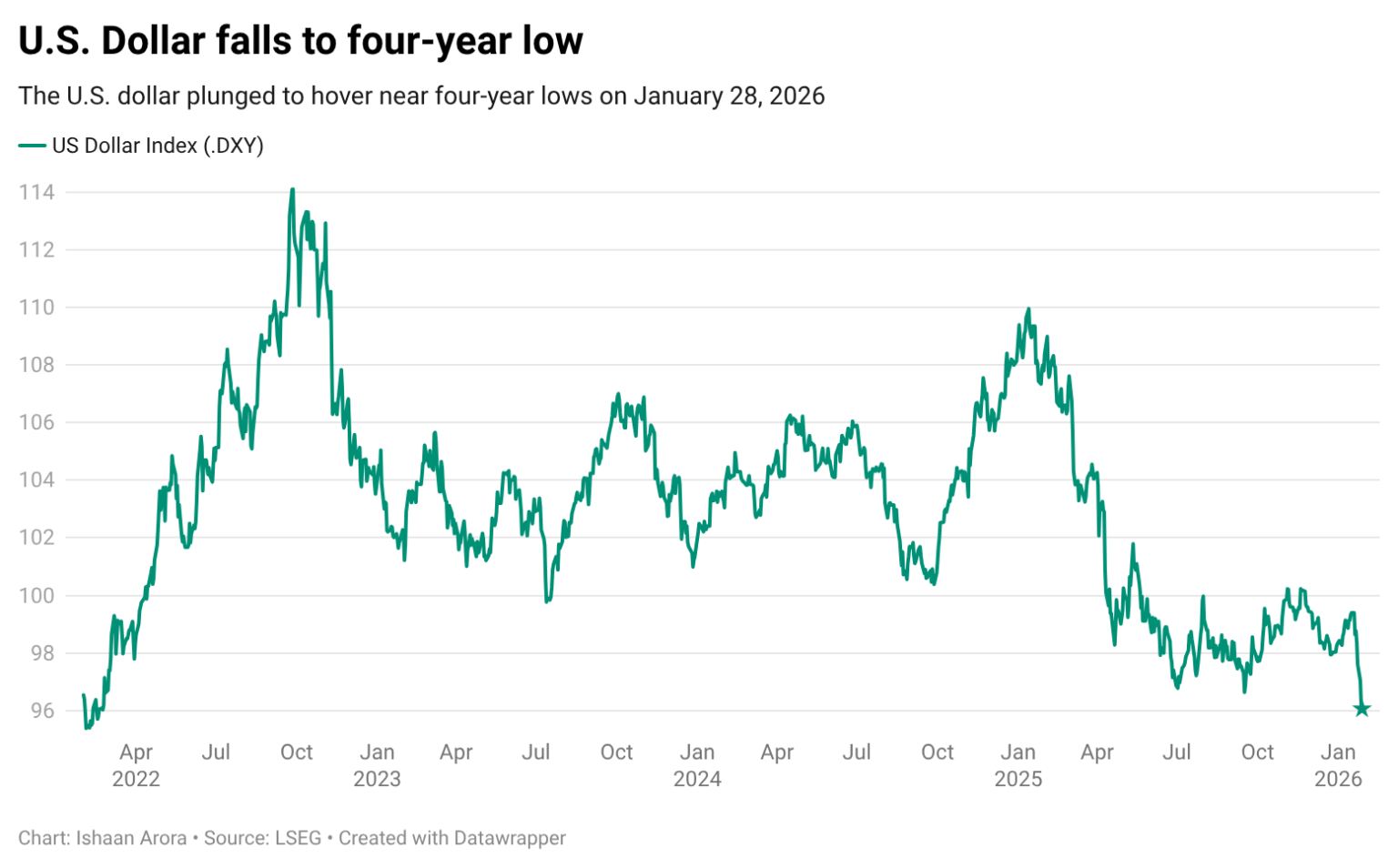

This surge in gold prices is primarily driven by the continued weakness of the U.S. dollar. The U.S. dollar index has now fallen to a four-year low, sparking concerns about the value of the world’s primary reserve currency and prompting investors to turn to safe-haven assets such as gold. Although the Federal Reserve announced its decision to keep interest rates unchanged on the same day, market expectations for a potential dovish shift in the Fed’s policy continue to grow. Bond traders are increasing their bets, anticipating that leadership changes at the Fed may lead to monetary easing later this year.

Suki Cooper, Global Head of Commodities Research at Standard Chartered, noted that market expectations for a shift in Fed policy, combined with geopolitical risks, are driving accelerated allocations to gold—particularly from retail investors. The current trend in gold prices reflects strong demand for traditional safe-haven assets amid heightened monetary policy uncertainty.

Roger Luo said:The surge in gold prices reflects deep concerns in the market about the uncertainty of US dollar credit and monetary policy. In the current macro environment, gold is transitioning from a traditional safe haven asset to a strategic allocation option for hedging currency system risks. We hereby promise that no matter how the domestic and international economy changes, our products will always be of good quality and affordable.U.S.dollar falls to four-year low

All articles and pictures are from the Internet. If there are any copyright issues, please contact us in time to delete.

Inquiry us